This will help ensure that there are no mistakes that could delay your refund or result in a penalty from the IRS. If you’re unsure about something, don’t hesitate to look up the instructions or ask someone who knows more about taxes.įinally, once you’ve finished the form, double-check everything before you submit it. Next, take your time and fill out the form completely and accurately. You can find most of this information on your W-2 form from your employer. This includes your income, deductions, and any credits you may be eligible for.

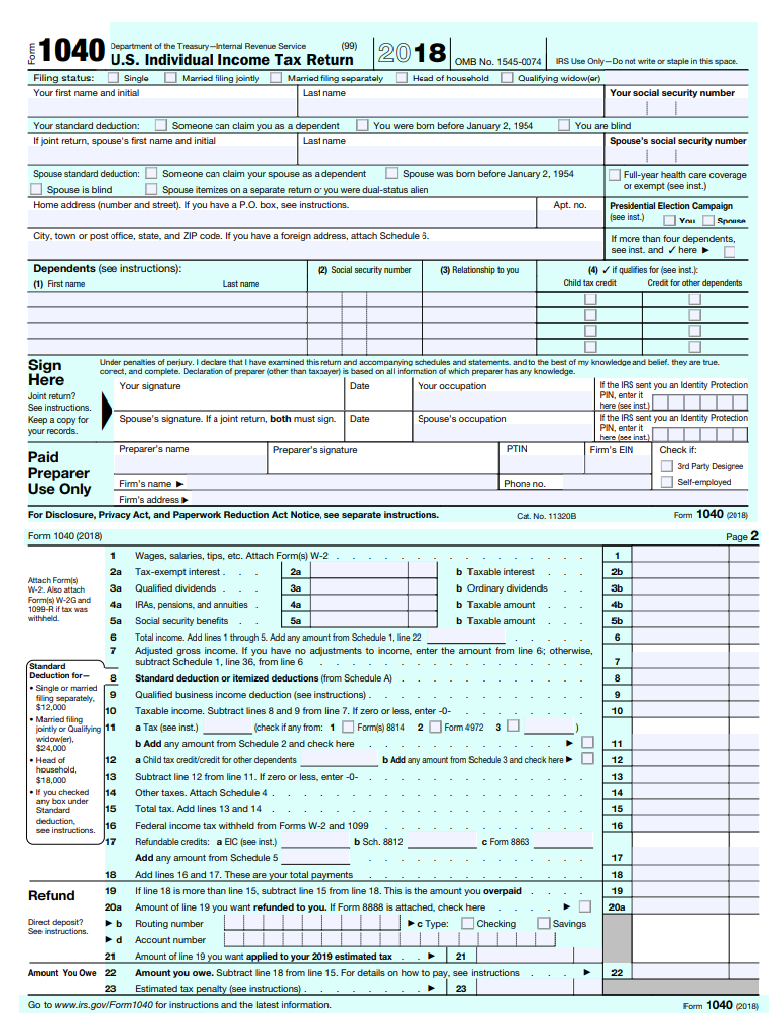

It can be a bit daunting, but some tips can make the process easier.įirst, make sure you have all the necessary information. Tips for completing IRS Form 1040įorm 1040 is the standard tax form used by individuals who are filing their taxes. The most common form used by individuals and married couples filing jointly is a two-page document that includes numbered lines to help you find the information you need. The IRS has revised Form 1040, and many of the lines from the previous form have changed.

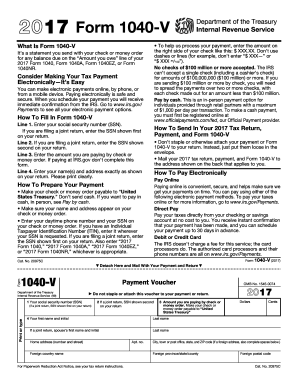

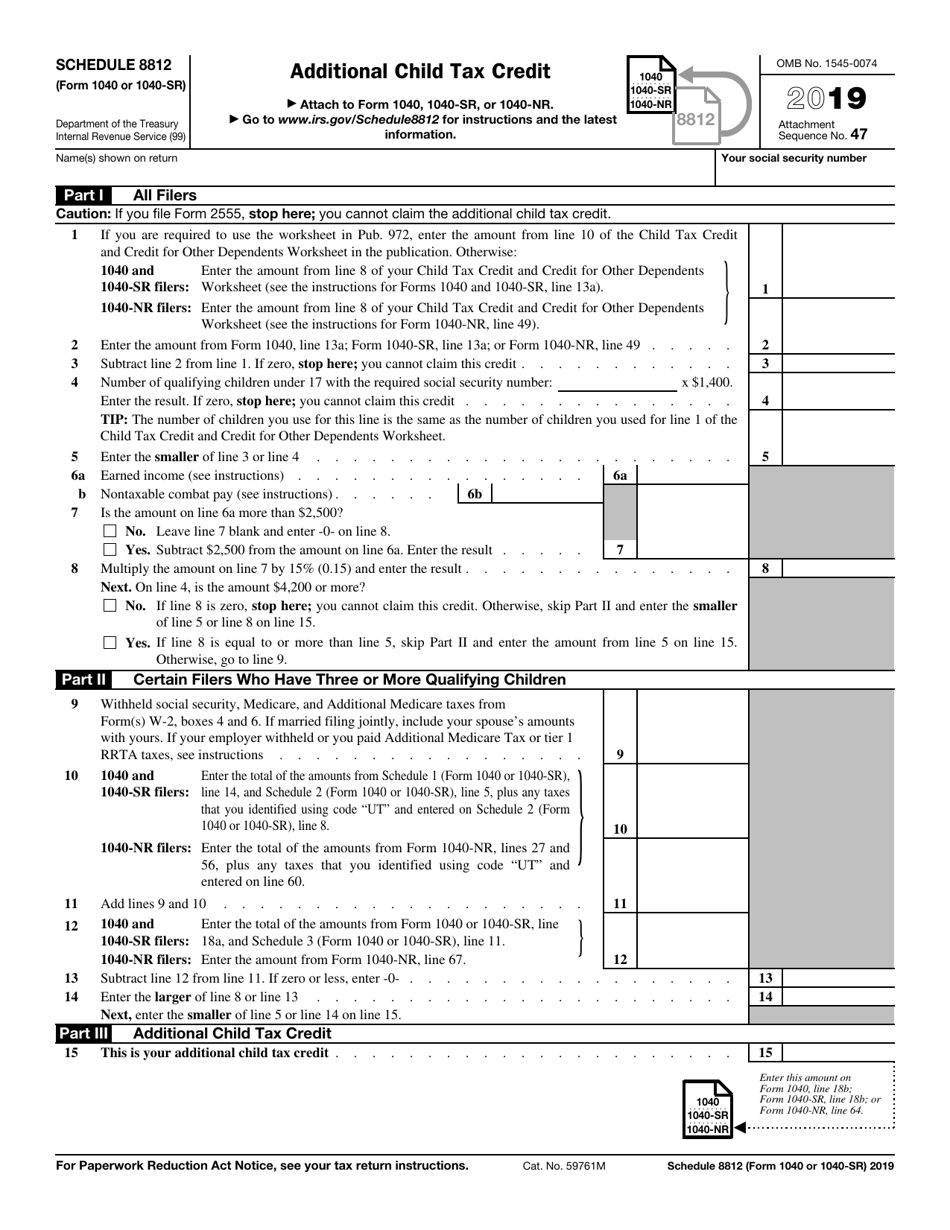

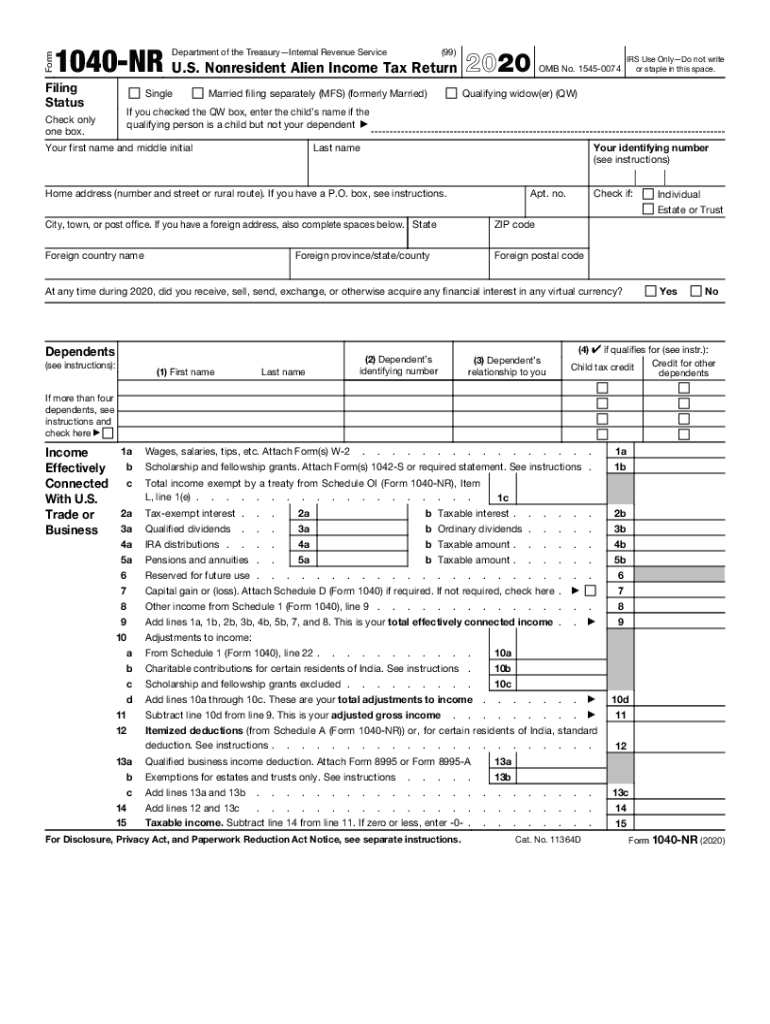

The IRS has revised Form 1040, and many of the lines have changed Most taxpayers will use Form 1040 to file their taxes, but other forms may be required in specific circumstances.įor example, self-employed individuals must use Form 1040-ES to calculate and pay estimated taxes throughout the year. The instructions for Form 1040 provide guidance on how to complete the form and where to find additional information about specific tax situations. The form reports an individual’s annual income, calculates taxes owed, and requests refunds for overpaid taxes. TurboTax is a popular tax preparation software that offers a free version for simple returns.įorm 1040 is the standard individual income tax form in the United States. You can also find Form 1040 on the TurboTax website.

0 kommentar(er)

0 kommentar(er)